Paul Ramoya, Mortgage Development Officer at Santander Bank, tells us about things you should know before applying for mortgage. What’s a credit score, how to prepare financially, things you should or should not do, and what to watch out for, before you even start thinking about buying a house.

Listen to podcast here:

[acf field=”mp3_link”]

Watch the video here:

[acf field=”yt_embed”]

Topics we talked about:

- When Paul started working in mortgage business

- How mortgage rates changed over years

- Things to do before you even start thinking about buying a house.

- Process of getting a mortgage

- Pre-approval vs pre-qualification

- Credit score and how it affects you

- Mistakes people make before getting a mortgage

- What people think they can afford vs what they really can afford

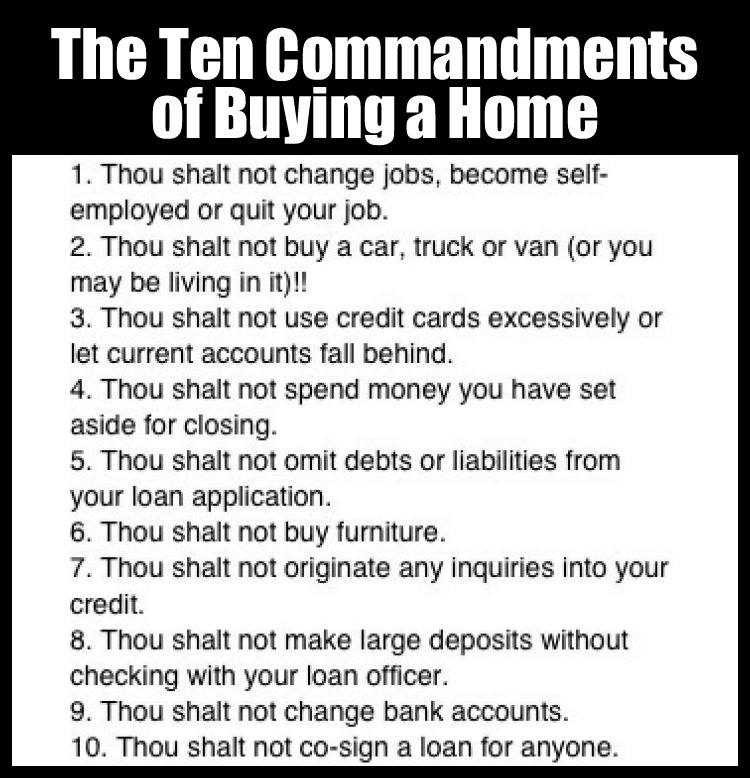

- Ten Commandments of buying a home:

Links mentioned:

Books/apps/tools mentioned:

- Facebook Messenger

Guest contact info:

Paul Ramoya

FB: https://www.facebook.com/Ramoya

paul.ramoya@santander.us